Mirrortable - The Desire Private Asset Investment Process using Web3

Opportunity

As the world’s Central Banks continue to further compress interest rates and the cost of capital, we are heading into a conodium where there aren't enough opportunities (at least philosophically) out there for investors to deploy their capital to work, especially in the public equity market. Private asset market, on the other hand, is an area where there are still substantial opportunities to generate alpha given the lack of cohesive deal sourcing, price discovery and unique deal structure (i.e. combo financing structure with owner financing, SBA financing, crowdfunding, Reg CF, Reg A+, Reg D etc.).

Not to mention the public market proxies for private asset market performance has done relatively well over in the trailing 12M and 24M (as of Jan 2nd, 2022), including Blackstone ($BX), KKR ($KKR), Carlyle Group ($CG), Brookfield ($BAM) and Constellation Software (CSU.TO/$CNSWF). There is a high probability these proxies will continue to perform exceptionally well given that there is still alpha to be seeked and created in the private asset market. Private companies and startups are also staying private longer than decades ago due to a wide range of factors, including the relative ease of access to deep dry powder. The Generalist - Tiger Global: How to Win wrote a solid piece on how Tiger Global changed the game of VC investing in just the past few short years.

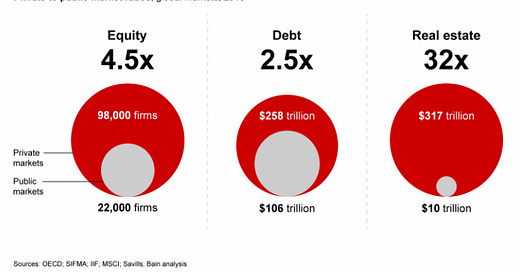

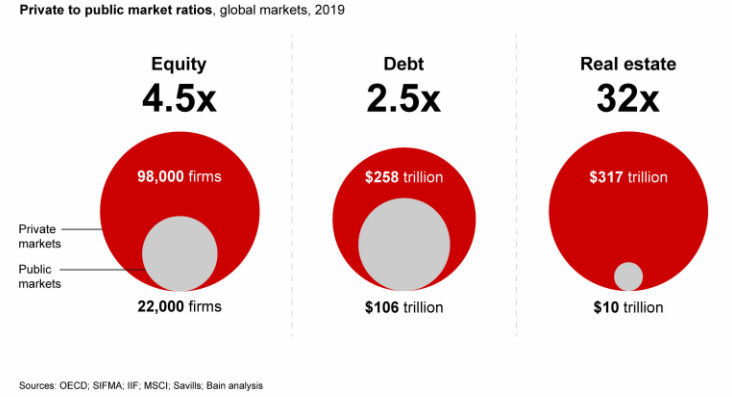

Bain recently reported that the size of private markets across three major asset classes significantly exceeds public markets by a factor of 2.5 in the case of debt markets, 4.5 in equity markets and over 30 in real estate. Furthermore, the private equity asset value has grown several magnitude faster than that of the public equity market capitalization. For Digital Assets, Private Markets Offer the Greatest Opportunities

And I believe this trend of private asset growth and opportunity for both institutional and retail investors to gain exposure to this space will grow exponentially, especially given the advent of Web3.

The Problem

There are substantial opportunities to create alpha and opportunities in private asset investment but there are also structural problems for both retail and institutional investors including the lack of standardized reporting structure (i.e. 10-K’s and 10-Q’s are required by most public companies), lack of compliance reporting, and arduous and error prone process of deploying capital into these private assets, and

This is where the potential for digital assets’ impact in private markets could be much greater than that in the public markets.

The status quo of private asset investing, including angel investing includes the following:

Deal source the opportunities (CF platforms and marketplace platforms have made this a bit easier as they aggregate deal sources i.e. Roofstock, LEX for private SFR, MF and commercial real estate investing)

Communicate with other investors via WhatsApp, Email, Phone, Twitter and Telegram to schedule initial meeting and pitch calls with founders

(Frontier is one such awesome community for like-minded investors to share their thoughts and perspective on both public equities and private asset investments with strong emphasis on user data and communication privacy)Meet with Founders and Management Team and conduct reference checks, if applicable. Then review all sorts of legal documents from SAFE Note, convertible debt, bridge debt, equity and any sort of financing agreement and structures out there.

Download the executed agreement and store it in Dropbox and/or store it on the Carta account.

Get the wire information and submit the wire, wait a few days for the wires to hit, and sometimes your bank (or the company’s bank) will hold the wire for review which could delay the process further. Company will manually verify this wire deposit in their bank account.

Company will add you to Carta, Clerky and other Web2 cap table management tools. You will periodically receive updates about the business performance and you will have to manually reach out to the company to get the latest valuation update as it does not automatically get updated in Web2 cap table management tools today.

The Desire Private Asset Investment Process using Web3

Investor sends investment in stablecoin (USDC, DAI, USDP etc.) from their ENS to the company’s ENS (or any other wallets/access points from Unstoppable Domains, Bonfida / Solana-based, Avvy / Avalanche-based, and others) and get transfer confirmation within just a few hours. These digital assets (or alternatively, it’s a form of tokenized cap tables) are then mirror to Web2 cap tables, also called Mirrortable. This mirror allows the asset valuation to be updated live across the investors portfolio regardless of which Web2 cap table services their portfolio companies are utilizing.

Know-Your-Customer/Know-Your-Business/Anti-Money Laundering (Alloy and Socure are great products in space), and Accreditation for accredited investors and other investor credentials and compliance acts can be processed with Web2 tools and live and time-stamped data can be written on-chain of the investor’s ENS so companies can take outside investments with confidence, similarly, this functions like an investors ‘global passport’ concept.

This on-chain investor credential and compliance data record also makes it easier to deal source and deploy capital cross-border.

Web2 Cap Table

Web3 Mirrortable

Mirrortable

Mirrortables are to cap tables as stablecoins are to fiat currencies. They streamline and internationalize the logistical mess of angel investing.

Mirrotables consists of an on-chain smart contract and a bidirectional interface that syncs changes made on-chain to the off-chain Web2 cap table, in part to stay compliant and recordkeeping and in another part, to help ease the ramp from Web2 to Web3.

Because a given company usually keeps all their fundraising rounds within the confines of a single platform like Carta, that platform could easily write a mirrortable for a company’s cap table to a blockchain on-chain system. For all the current Web2 cap table companies operating in this perspective, I would argue it’s prudent and pertinent to focus on scaling up the number of companies and subsequently, the number of investors and cap table entries using your off-chain system given the long lifecycle of cap table management.

Carta, AngelList, CLerky, LTSE, Pulley and others will be reading and writing mirrortables for all companies on the Ethereum blockchain (or any other chains), using it as a form of shared state. This will drastically help investors with portfolio valuation updates as well in the future, provide an easy on-ramp to trading of tokenized assets in alternative trading systems (ATS’s).

Features of the Mirrortable

ENS, SOL Name Service or any other blockchain Name Service minimize fraud and wire transfer risks (i.e. there is only one ever Vertalo.ENS with that unique address in the world) that exist in status quo

Security Protocol - can layer on private keys from both investor and company end to add extra layer of security and confirmation can be viewed on chain

On-Chain Compliance Data - compliance and user credentials

(KYC/KYB/AML/Accreditation) information will be coded on-chain associate with that Name Service/investor wallet and for some of these compliance, can set a predetermined cadenced logic i.e. run KYC again before investors invest in another investment offering or run AML every 15-30 days and all that new data will be written on-chain, viewable by certain party as determined as the users themselvesInternational applicability - once the above is done, investors can theoretically invest anywhere on earth as long as the new data run logic is compliant with local jurisdiction (easier to do it as you only need to write the code logic on a per country basis, which has way less # countries vs # of investors and status quo of going through that process today)

Handles transfer restrictions and lockups - Easier to facilitate transfer (i.e. all transfers of the mirrored equity can only happen based on a x and y logic), lockups logic can also be build in (i.e. vested shares of employees and only 10% of that with scaled up effect can be liquidated on ATS or to other investors etc.)

Social Proof - some investors will want their portfolio to be public and also it’s easier for companies (companies that these investors will want to invest in) to verify the investment connection.

Instant Valuation Update - Updated valuation of startup equities can be updated instantly across the board from the investors POV

As long as there are retail and institutional investors involved in any investment opportunity, cap table will continue to play a systemically important role in how both the public and private asset market functions for transparency and compliancy.

Backwards legal compatibility is key to Web3 Mirrortable adoption as it does not require any changes to the law because they are riding on top of compliant Web2 cap table platforms, and layering on the investor compliance and credential on-chain data recording could further democratize domestic and cross-border investing.